Uncategorized

Rent-to-Own Programs

With the rising costs of housing, looming student loans and stagnation of wages, the entry to home ownership has risen quite significantly. There are alternatives to the traditional way of purchasing a home that has given millennials, Gen Z and those facing financial constraints a way to finally get a deed of their own.

Rent-to-own programs bridge the gap between renting and owning a home. Rent-to-own programs are also known as lease options or option contracts.

These programs allow for a renter to move into a home, pay rent and build equity at the same time. A portion of the rent is allotted to a down payment account to be used when the renter purchases the home.

Another benefit is that the renter has time to work on their credit while they are in their dream home to achieve a better interest rate when the time comes for them to purchase the home in which they already reside.

The renter can also lock in a purchase price, which can save the renter thousands in this ever-rising housing market. (Although if prices ever drop, the renter could over-pay for the house). It is very important to have all the terms clearly listed in the contract to avoid any surprises.

The down-side is that the renter cannot apply for the homestead exemption on property taxes, does not have the mortgage-interest deduction for income taxes, and missing a payment can void the rent-to-own contract and any equity is forfeited.

A rent-to-own program is not for everyone, but it can lower the bar of entry to homeownership for a large majority of the home-buying population. There are pros and cons to any avenue of homeownership, so due diligence is important in making sure that this is the right option for you.

Christine Fleury is a real estate closing attorney with Origin Title and Escrow, Inc. Since 2003, Origin Title has handled real estate transactions – purchases, refinances, reverse mortgages – quickly and professionally. There will be no surprises, nothing misunderstood. Title searches are thorough and well-reasoned, to avoid unpleasant surprises later down the road. Calculate your closing costs in Georgia or Florida using our calculator or contact Origin Title using this form.

Ensuring Correct County Recordings

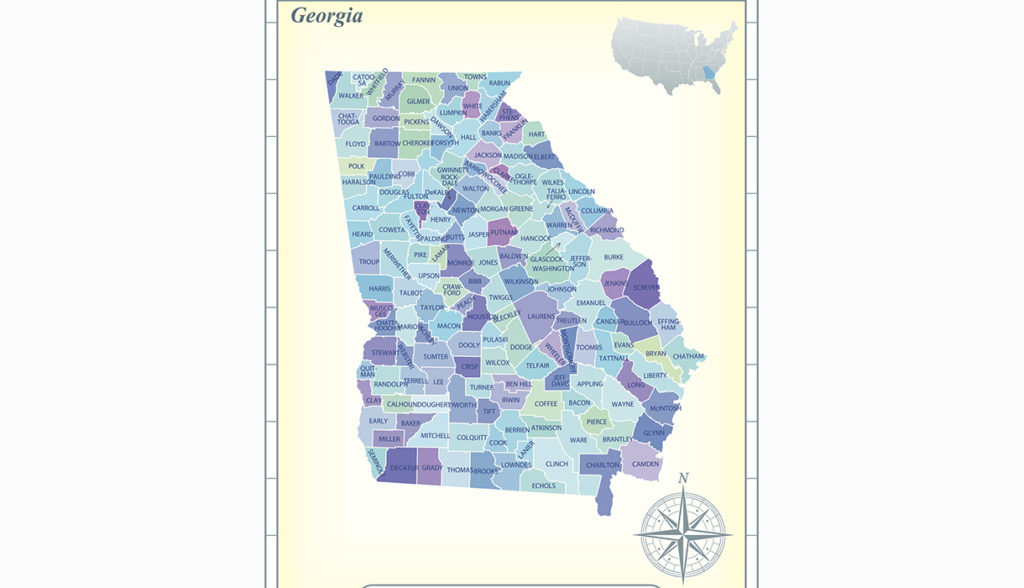

As of July, 2021, the Atlanta metro area includes 11 counties. Having an Atlanta mailing address does not mean the property is in the official city limits. A house can have an Atlanta address and be located in Cobb, DeKalb, or Fulton county.

When a homeowner refinances or sells property and pays off a mortgage, the mortgage lender files a release in the county records. Many times, the lender will use just the city name and zip code to file the release, meaning they are often filed in the wrong county. When a title search shows an open mortgage that we expect was paid in full, Origin Title searches to see if it was filed in the wrong county. Most of the time, we discover that it was. Origin Title will then get a certified copy of the release and file it in the correct county to keep problems from arising in the future.

We recommend that borrowers keep copies of any releases from mortgage lenders. This will reduce the chance of delays when the property is being sold or refinanced due to an old mortgage still showing as open in the county public records.

Can my spouse be on the title to the house, but not on the loan?

Yes! When you borrow money to buy a house, there are two separate and distinct promises you are making.

First, the personal liability is the promise to personally pay back the loan. This is represented by the promissory note at closing. Lenders look at the credit rating of anyone signing the promissory note.

Second, is the promise to give the house to the lender if the loan can’t be paid back. The property owners sign the Security Deed at closing to put the house or land up as collateral for the loan. Everyone with an interest in the property must sign the Security Deed. The property owners and borrowers aren’t necessarily the same people.

There are certain reasons it might make sense for only one person to apply for the loan. Contact us to discuss, we can answer your questions on how these decisions can impact your specific situation.

A Prompt Filing Date

When a title search is completed, there is always an effective date on the title commitment. This is the date the county clerk has processed all of the deed filings. Believe it or not, the filing date is very important because whichever lien or security interest is filed first has priority. Being in first lien position allows the lender to foreclose on the property and wipe-out almost all subsequent liens and mortgages.

Have you ever been in line for tickets and get the last one? Do you feel bad for the people behind you? That’s how liens work. When a borrower defaults, the lien holders all line up and once the property is gone, anyone behind that person is out of luck.

Mortgage lenders could greatly benefit from working with Origin Title & Escrow, who will file their deeds promptly to protect their interest in the property.

A spouse automatically inherits the house from their deceased spouse, right?

The answer is no. It is not automatic and surviving spouses can be in a bind if they aren’t prepared.

Ideally, spouses are listed as “joint tenants with right of survivorship” on the vesting deed. If this is the case, then the surviving spouse automatically becomes the owner of the property. This is also true for any co-owners of property in Georgia, not limited to married couples.

If a married couple does not have this listed on the deed, hopefully a will is in place where everything is left to the other. The will would need to be probated after the person’s death, and then a deed would be prepared from the executor of the estate to the surviving spouse.

If there is no survivorship on the deed AND no will, then a surviving spouse could file for a year’s support in probate court within two years of the death in order to get the house.

If none of the above is set in place, then the owners would become ALL of the heirs, including children or anyone else entitled to inherit the home.

Origin Title always ask buyers if they want to be joint tenants with survivorship at closing, which can save thousands of dollars and headaches down the road.